So, I’ve been diving into this nifty app called Solo: Your Gig Business App, and let me tell you, it’s like having a personal assistant for your gig economy adventures. If you're juggling multiple gigs and need a way to keep everything organized, this app might just be your new best friend.

What’s Solo All About?

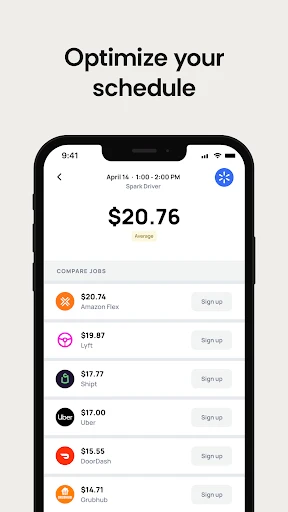

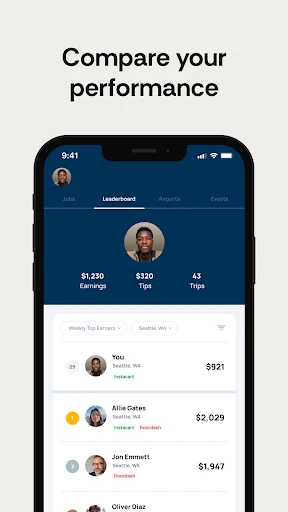

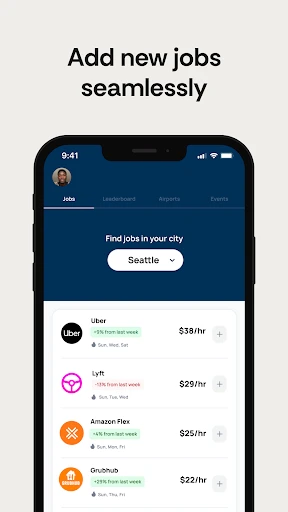

Picture this: you’re a freelancer, and you’ve got gigs coming in from every direction. Solo: Your Gig Business App swoops in to save the day by helping you track income, expenses, and even mileage. It’s super intuitive and designed specifically for folks in the gig economy.

The interface is sleek and user-friendly, which means you won't spend hours trying to figure out where everything is. You just open the app, and it’s like, "Hey, I got this. Let’s get to work." You can link your bank accounts, and it automatically pulls in your transactions. It’s kind of magical.

Features That Stand Out

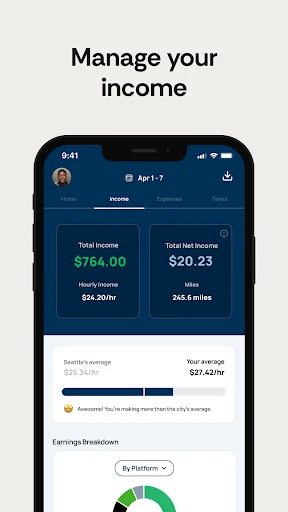

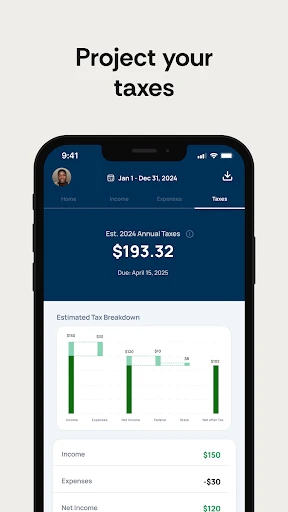

What really caught my eye were the automated features. For instance, Solo suggests deductions based on your expenses, which is a lifesaver come tax season. No more last-minute scrambling to figure out what you can write off.

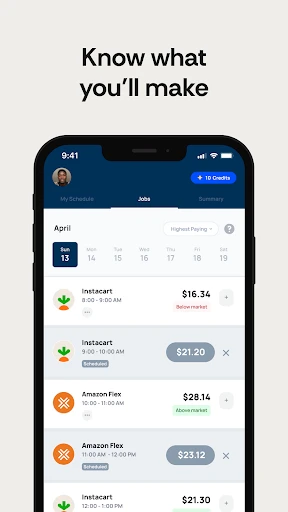

Another cool feature is the income prediction tool. It analyzes your previous earnings and gives you an estimate of what you can expect in the future. It’s like having a crystal ball for your finances.

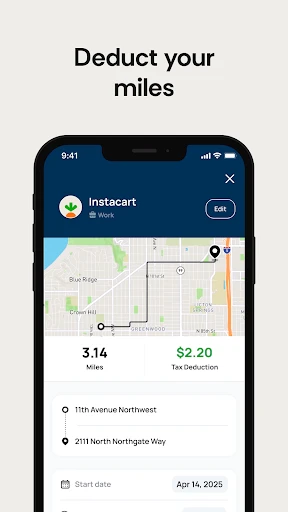

And, if you’re on the go, the mileage tracker is a game-changer. Just hit start when you begin your journey and stop when you’re done. The app logs everything for you. Easy peasy!

Things to Keep in Mind

While Solo is pretty robust, it’s always good to keep in mind that it’s best suited for freelancers and gig workers. If you’re running a more traditional business, you might find it lacking some features you’d need.

Also, the app offers a free version, but for those top-tier features, you’ll need to subscribe. It’s not a dealbreaker, but something to consider if you’re budget-conscious.

My Final Take

All in all, Solo: Your Gig Business App is a solid choice for anyone looking to streamline their gig work. It’s like having a financial sidekick that’s always got your back. Whether you’re delivering food, driving people around, or doing freelance writing, this app helps you keep everything in check.

So, if you’re buried under receipts and spreadsheets, give Solo a whirl. It might just be the helping hand you didn’t know you needed.